In the Philippines, bingo winnings are generally classified as “other income” and are subject to a final tax. the Tax Reform for Acceleration and Inclusion (TRAIN Law) subjects these winnings to a 20% final tax. Therefore, if you won PHP 10,000, you would pay PHP 2,000 in tax, leaving you with PHP 8,000.

Understanding the Philippines’ Tax System

Understanding how this system works can help in interpreting the taxation on bingo winnings in the country.

Brief Overview of Philippines Tax Law

Philippines Tax Law, also known as the National Internal Revenue Code, dictates all tax related matters in the country. It includes regulations on income tax, estate and donor’s taxes, value-added tax, excise taxes, and documentary stamp taxes, among others. These laws are essential in determining the tax liabilities of individuals, corporations, and other entities within the country. Various amendments over the years have modernized the tax law, making it adaptable to the evolving economic environment. For example, the recent Tax Reform for Acceleration and Inclusion (TRAIN) Law introduced a range of adjustments to personal income tax, estate tax, and excise tax, among others.

Tax Categories in the Philippines

The Philippines tax system classifies taxes into national and local taxes. National taxes include income tax, value-added tax (VAT), excise tax, and documentary stamp tax. The proper classification of income is crucial to determining tax liabilities in the Philippines.

How are Bingo Winnings Classified Under Philippines’ Tax Law?

Understanding the specific categorization of bingo winnings under the tax law in the Philippines is crucial for anyone engaged in the game, as it directly impacts the amount of taxes one has to pay.

Classification of Gambling Winnings

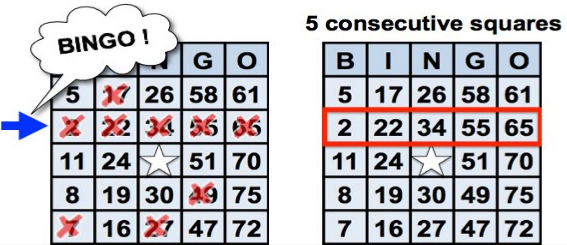

According to the Philippines tax law, all winnings from gambling activities are generally classified as “other income”. This category covers income not related to employment, business, or profession. As such, bingo winnings, like all other gambling winnings, fall into this category.

Specific Laws on Bingo Winnings

In relation to bingo winnings, there are specific regulations under the Bureau of Internal Revenue rulings. One such regulation specifies that all prizes or winnings from PCSO Lotto and other lotto games are subject to 20% final tax under the TRAIN law.

Calculation of Tax on Bingo Winnings in the Philippines

The taxation of bingo winnings in the Philippines depends on a variety of factors. Understanding these can help you determine how much tax you owe on your winnings.

Percentage of Tax on Bingo Winnings

Under the Philippines’ tax law, bingo winnings, like other forms of gambling winnings, are generally subject to a final tax. This means that the tax is withheld directly at the source. According to the Tax Reform for Acceleration and Inclusion (TRAIN Law),, these winnings are subject to a 20% final tax.

How to Calculate Your Tax

Calculating the tax on your bingo winnings is relatively straightforward. You simply take the total amount of your winnings and apply the final tax rate. For instance, if the tax rate is 20%, and you have won PHP 10,000 playing bingo, your tax would be PHP 2,000.

Procedure to Pay Tax on Bingo Winnings in the Philippines

Fulfilling tax obligations in a timely and proper manner is essential for all taxpayers, including those with bingo winnings. It not only ensures compliance with the law, but also prevents unnecessary penalties.

Reporting Your Bingo Winnings

In the Philippines, bingo winnings, like any other form of income, must be reported to the Bureau of Internal Revenue (BIR). This typically involves filing an income tax return, where you declare all forms of income received within the tax year, including your bingo winnings. If the bingo operator has already withheld the tax, it’s crucial to obtain a copy of the withholding tax certificate, as it provides proof of tax payment.

Filing and Payment Process

After reporting your winnings, the next step is to file and pay the tax. The BIR has several forms for different tax types, and you must select the correct form for your income category. most taxpayers use BIR Form No. 1701 for annual income tax return for individuals, including earnings from gambling. For convenience, the BIR also offers online filing and payment solutions through the eBIRForms and ePay platforms.

Penalties for Non-Compliance

Failure to comply with the tax laws in the Philippines may result in penalties. These include surcharges, interests, and compromise penalties. It’s therefore essential to file and pay taxes on time to avoid these penalties and potential legal issues.

Impacts of Taxes on Bingo Players in the Philippines

The imposition of taxes on bingo winnings in the Philippines can have various impacts on the players. These effects can be both financial and behavioral in nature.

Financial Impacts

The most direct impact of the taxation on bingo winnings is financial. The requirement to pay tax reduces the net gain from playing bingo. For instance, if a player wins PHP 10,000 and is taxed at 20%, their actual take-home winnings will be PHP 8,000. This significant reduction can impact how much players are willing to stake and their potential profits. In some cases, the tax could even discourage some people from participating in bingo games.

Behavioral Impacts

Aside from the financial implications, the taxation on bingo winnings can also influence the behavior of players. They might choose to play less frequently or bet smaller amounts to manage their potential tax liabilities. In extreme cases, it might drive some players to seek illegal or offshore bingo games where taxes are not enforced. Understanding these potential behavioral changes is crucial for both the Bureau of Internal Revenue (BIR) and the Philippine Amusement and Gaming Corporation (PAGCOR), the government agency that regulates all games of chance in the country.

FAQ: Tax on Bingo Winnings in the Philippines

Addressing frequently asked questions can help clarify common queries and concerns about the taxation of bingo winnings in the Philippines.

Do All Bingo Winnings Get Taxed?

As a general rule, all gambling winnings, including bingo, are subject to tax under Philippines law. However, there might be some exceptions or specific situations where the rules differ. For the most accurate information, it is advisable to consult with a tax professional or directly with the Bureau of Internal Revenue.

What to Do If I Didn’t Report My Bingo Winnings?

If you didn’t report your bingo winnings in your income tax return, it’s best to rectify this mistake as soon as possible to avoid penalties. You can file an amended return with the BIR, where you include the missed information.

Is There a Way to Reduce Tax on My Bingo Winnings?

There may be ways to legally reduce the tax on your bingo winnings, but they largely depend on the specific tax laws and regulations in the Philippines. For instance, some expenses directly related to your gambling activities might be deductible. However, tax laws are complex and may change over time, so it’s always best to seek advice from a tax professional or the BIR. Remember, while it’s natural to want to minimize your tax liability, it’s also crucial to comply with all tax laws to avoid potential legal problems in the future.